We build sustainable relationships

Our customers, employees and suppliers are our priority. In order to meet their expectations, we have developed various mechanisms based on sustainability policies to monitor our relationship:

We create opportunities for dialogue

Feedback from the different stakeholders is essential for improving the services provided and the relationship with stakeholders. So, we provide different communication channels for each group:

Communication channels

Requesting face-to-face feedback via questionnaires and meetings

Intranet (we are novobanco, yammer internal social network and Human Resources Portal)

Thematics mailboxes (including CEO Office and "Ask CAE")

HCD Manager of current and retired employees

Human Resources Business Partner

Executive leadership visits to the commercial network

Whistleblower Line

Workshops and Lectures

Annual meeting and other themed meetings, workshops, information sessions and webinars

Workers' Committee, Trade Union Secretariat and Information and Consultation Procedure

Requesting feedback in person, online and by telephone

Formal system for submitting complaints

Branches network, Business Centres and Regional Divisions;

Social networks (novobanco Culture, Facebook novobanco and Linkedin); Events.

Mandatory and voluntary reporting

Request feedback by phone, online and in person

Investor Relations Team

Regular meetings with investors

Quarterly presentation of results

Investor website

Contacts established through a specific website (novobanco Group Supplier Portal), with information exchanged via e-mail, telephone and in person.

Providing information in person, by telephone and online:

Press Conferences

Quarterly presentation of results

Sharing specialised knowledge through social networks and the media (radio, newspapers, television)

Ongoing face-to-face, telephone and online dialogue with Associations, IPSS, social and environmental NGOs

Corporate Social Responsibility Initiatives

Participation in conferences

Social networks (novobanco Culture, Facebook novobanco and Linkedin)

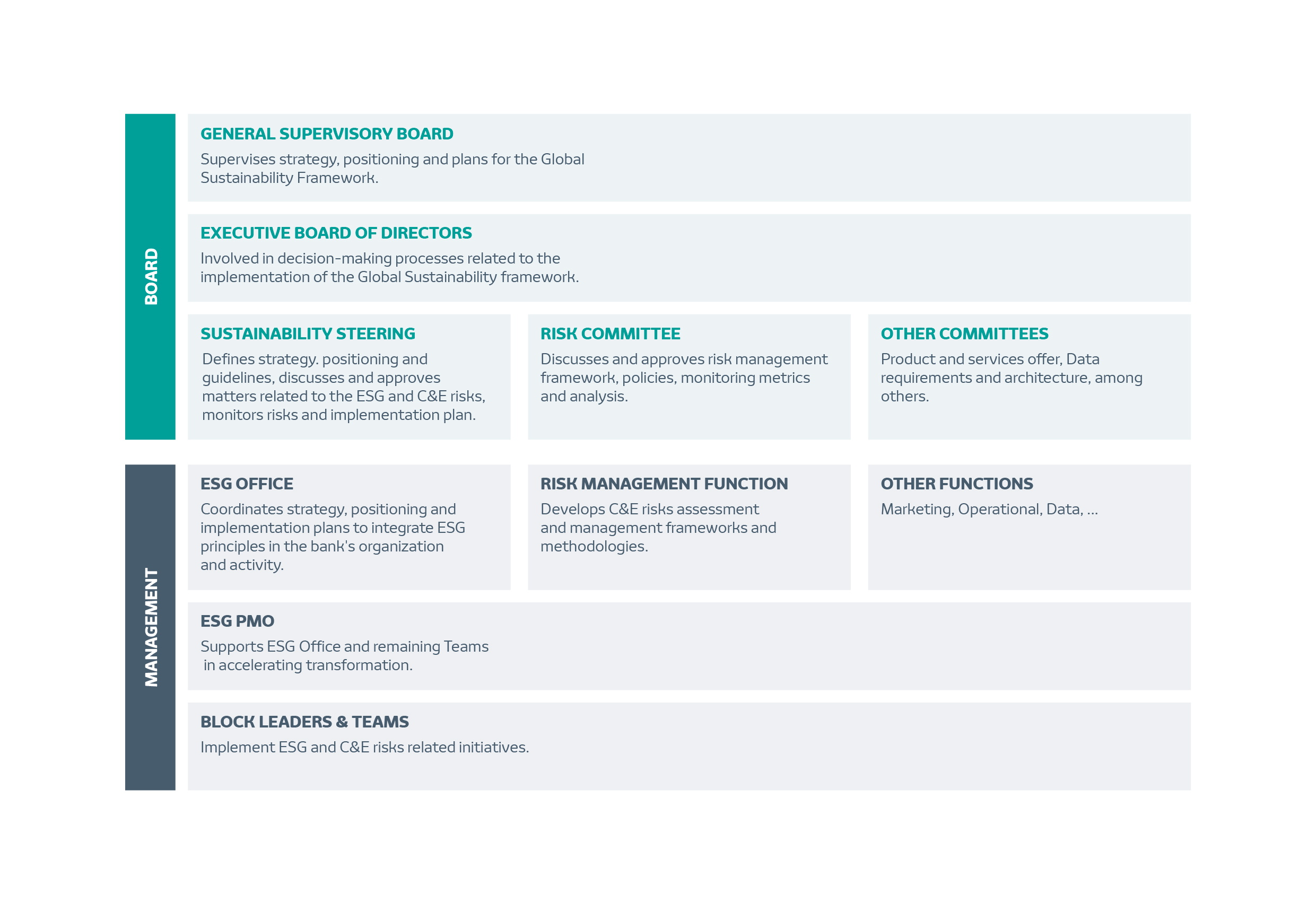

We follow a robust Governance model

Having a structured governance model, supported by policies and principles that ensure the effective and prudent management of our activity, is a fundamental indicator for the sustainability of our business. To this end, ESG strategy and risk management is conducted directly by the Executive Board of Directors (EBD), which participates directly in defining the strategy and action plans, and is supervised by the General Supervisory Board (GSB).

In this way, regular monitoring of the bank's implementation plans and ESG performance is ensured, as well as acting with transparency and impartiality.

ESG policies and principles

- English

Green Financing and Investment Classification Policy

Green Financing and Investment Classification Policy

Green Financing and Investment Classification Policy

Green Financing and Investment Classification Policy

Financing Principles - Sectors/activities exclusions and minimum safeguards

Financing Principles - Sectors/activities exclusions and minimum safeguards

Financing Principles - Sectors/activities exclusions and minimum safeguards

Financing Principles - Sectors/activities exclusions and minimum safeguards

Policy and Principles ESG

Qualification and Incentives

In addition to the priority given to ensuring an organizational model and policy framework that promotes the integration of ESG into the business model, novobanco also prioritizes two essential tools for integrating ESG into the bank's culture:

Ensuring the development and deepening of knowledge and skills at all levels of the organization. The bank's management team (General Supervisory Board and Board of Directors) as well as the specialized teams of the ESG Office and the risk function receive additional and in-depth training on ESG topics and risk management of climate and environmental risks.

Integrating ESG indicators in the performance assessment and variable remuneration of the management team: the collective and individual KPIs for evaluating the performance of EBD members include ESG objectives. Every year, these KPIs and targets are reviewed and approved by the GSB. The departmental performance assessment model also includes ESG KPIs at the corporate level and, when applicable, a specific ESG KPI.

We establish sustainable partnerships

In the quest for a more sustainable world, we have the support of several important organisations in Portugal. These are partnerships that we have built up and that we intend to maintain, always with one goal in mind: A better future.

.jpg/_jcr_content/renditions/cq5dam.thumbnail.48.48.png)

.jpg/_jcr_content/renditions/cq5dam.thumbnail.48.48.png)