Composição do CAE para o quadriénio 2022-2025

Mark Bourke

Chief Executive Officer (“CEO”)

Benjamin Dickgiesser

Chief Financial Officer (“CFO”)

Luís Ribeiro

Chief Commercial Officer Corporate (“CCOC”)

João Paixão Moreira

Chief Commercial Officer Retail (“CCOR”)

Luísa Soares da Silva

Chief Legal, Compliance & Sustainability Officer (“CLCSO”)

Carlos Brandão

Chief Risk Officer (“CRO”)

Rui Fontes

Chief Credit Officer (“CCO”)

Notas Biográficas

Chief Executive Officer (“CEO”)

Mark Bourke ingressou no novobanco como Chief Financial Officer - CFO em março de 2019 e em agosto de 2022 foi nomeado como Chief Executive Officer – CEO.

É um profissional especialista em Serviços Financeiros com vasta carreira nas mais importantes empresas do setor. Obteve o diploma em Contabilidade pela Dublin City University depois de terminar seu bacharelado em Engenharia Eletrônica pela University College Dublin.

Iniciou a carreira na PricewaterhouseCoopers (PwC) em 1989 e é ex-sócio em serviços fiscais internacionais da PwC US na Califórnia. Depois disso, no ano de 2000, ingressou no IFG Group como Diretor Financeiro e foi promovido a Chief Executive Officer do Grupo em 2006.

Antes de ingressar no novobanco, foi Chief Financial Officer do Allied Irish Banks (“AIB”) e membro da Equipa de Liderança do AIB, de 2014 a 2019.

É membro do Chartered Accountants Ireland e do Irish Taxation Institute. Mark Bourke foi distinguido com o prémio Irish Times CFO of the Year 2018.

Chief Financial Officer (“CFO”)

Benjamin Dickgiesser ingressou no Conselho de Administração Executivo do novobanco em fevereiro de 2023 como Chief Financial Officer - CFO.

Antes de assumir funções como do CAE do novobanco, Benjamin Dickgiesser foi Managing Director na Hudson Advisors Portugal LDA, onde apoiava a subscrição e gestão dos investimentos europeus dos fundos da Lone Star em instituições financeiras. Benjamin Dickgiesser também foi membro do Conselho Geral e de Supervisão do novobanco.

Com vasta experiência e conhecimento adquiridos nos últimos cinco anos no mercado português e no sistema bancário, o Benjamin Dickgiesser possui um profundo entendimento das operações do novobanco, da sua estratégica e amplo conhecimento dos mercados de capitais.

Benjamin Dickgiesser possui um mestrado (MSc) pela University College London e mais de 15 anos de experiência nos mercados financeiros. Anteriormente desempenhou funções no Financial Institutions Group da Divisão de Banca de Investimento do Citigroup em Londres e ocupou cargos na Lone Star Europe Acquisitions LLP, e foi membro do Conselho de Supervisão do IKB Deutsche Industriebank AG, na Alemanha.

Chief Commercial Officer Corporate (“CCOC”)

Luís Ribeiro é licenciado em Economia pela Universidade de Évora, tendo frequentado o Programa Avançado de Gestão para Executivos da Universidade Católica assim como o Advanced Executive Programe da Nova SBE.

É membro do Conselho de Administração Executivo do novobanco desde setembro de 2018, sendo também membro do órgão de administração do novobanco dos Açores, da Unicre - Instituição Financeira de Crédito S.A e da SIBS Forward Payment Solutions, S.A..

Ao longo dos seus mais de vinte e cinco anos de experiência bancária comercial, Luis Ribeiro desempenhou várias funções de direção, incluindo a coordenação do segmento sul de empresas, tendo sido anteriormente também responsável pelo segmento de retalho.

Chief Commercial Officer Retail (“CCOR”)

falta texto

Chief Legal, Compliance & Sustainability Officer (“CLCSO”)

Luísa Soares da Silva é licenciada em Direito pela Universidade Católica Portuguesa, Lisboa. Tem formação adicional em direito europeu, financeiro e mercado de capitais, incluindo um Programa Avançado de Gestão da Nova SBE e um programa de Strategic Management in Banking do Insead.

Em abril de 2017, juntou-se ao novobanco como membro executivo do Conselho de Administração. Antes de iniciar funções no novobanco, Luísa Soares da Silva exercia advocacia em especial nas áreas de atuação financeira, bancária, seguradora, mercados de capitais e corporate na Morais Leitão, Galvão Teles, Soares da Silva & Associados (MLGTS), desde 2001 como Sócia, tendo desde cedo na sua carreira assessorado em permanência instituições bancárias e seguradoras. Ao longo da sua carreira, Luisa Soares da Silva recebeu diversos reconhecimentos, incluindo a distinção em 2016 como Leading Lawyer in Capital Markets IFLR e Mergers and Acquisitions IFLR.

Chief Risk Officer (“CRO”)

Carlos Brandão é licenciado em Economia, possui um Mestrado em Gestão Comercial e Marketing e um Programa Avançado de Gestão.

Juntou-se ao novobanco como Diretor Coordenador do Departamento de Risco em julho de 2017, e em agosto de 2022 foi nomeado como membro executivo do Conselho de Administração.

Tem mais de 20 anos de experiência na gestão de equipas de elevado desempenho no sector bancário, em especial na área de Risco no Banco Santander e Barclays Bank, instituições de renome no mercado espanhol e inglês.

Em 2008, assumiu o cargo de Chief Risk Officer do Barclays Bank e em 2016 é nomeado CEO e Country Manager com os pelouros de Risco, Retalho e Controlo Interno

Chief Credit Officer (“CCO”)

Rui Fontes é licenciado em Economia pela Faculdade Economia da Universidade do Porto (FEP).

Rui Fontes é membro executivo do Conselho de Administração do novobanco desde abril de 2017, na qualidade de responsável pelas Áreas de Risco e Controlo Interno e em outubro de 2017 foi nomeado Chief Risk Officer. Em agosto de 2022 foi nomeado para Chief Credit Officer.

Ingressou no sector bancário em 1994, tendo assumido várias funções, primeiro na área comercial e posteriormente nas áreas de risco. Em 2000, ingressou no Departamento de Risco Global e em 2012 assumiu a responsabilidade pela coordenação deste Departamento, que manteve durante a transição para o novobanco e até à sua nomeação para vogal.

- Composition

- Bios

Composition for the quadrennium 2022-2025

Mark Bourke

Chief Executive Officer (“CEO”)

Benjamin Dickgiesser

Chief Financial Officer (“CFO”)

Luís Ribeiro

Chief Commercial Officer Corporate (“CCOC”)

João Paixão Moreira

Chief Commercial Officer Retail (“CCOR”)

Luísa Soares da Silva

Chief Legal Compliance & Sustainability Officer (“CLCSO”)

Carlos Brandão

Chief Risk Officer (“CRO”)

Rui Fontes

Chief Credit Officer (“CCO”)

Scope

Responsible for issuing an opinion on, approving, under the powers delegated by the Executive Board of Directors, and monitoring novobanco Group’s policies and risk levels. In this context, the Risk Committee is responsible for monitoring the evolution of the Group’s integrated risk profile, and for analysing and proposing methodologies, policies, procedures and instruments to deal with all types of risk, namely credit, liquidity, IRRBB, non financial and ESG.

Responsible for deciding the main credit operations in which the novobanco Group participates, in line with the risk policies defined for novobanco Group.

Responsible for the definition of the balance sheet management policies (capital, pricing, and interest rate, liquidity and foreign exchange risk) and for monitoring their impact at novobanco Group level. The CALCO also monitors early warning indicators with regard to the Recovery Plan and Liquidity, proposing mitigation measures, and if necessary, triggering the recovery plan and/or the liquidity contingency plan.

The Committee monitors all issues related to novobanco Group’s Internal Control System, without prejudice to the responsibilities attributed in this regard to the Executive Board of Directors and the Risk Committee, the Operational Risk Subcommittee and the Compliance and Product Committee. Among other responsibilities, this Committeee monitors the global internal defficiencies, analises the quality the control environment, produces improvement proposals and monitors Quality Assurance initiatives.

Responsible for approving, from a compliance standpoint, products and services to be developed and/or distributed by the bank, issuing an opinion on all of them within the scope of the products’ sign-off process in force, as well as monitor the issues related to control implementation, regulation and promotion of compliance with legal obligations, among other responsabilities

Responsible for the development of the strategic objetives estratégicos of digital transformation, eficiency and simplification of novobanco’s operations.

Responsible for approving the execution of expenses, within the limits of the powers conferred upon it. Its objectives include the definition of an annual expenditure plan and the revision of the acquisition’s strategy.

Responsible for defining the amount of impairment to be allocated to each client or group of clients.

In addition, the Executive Board of Directors has set up 3 (three) subcommittees, (i) Non-Performing Assets (NPA) Subcommittee; (ii) Extended Models Risk Subcommittee; (iii) Operational Risk Subcommittee and 7 (seven) steering groups for the areas of (i) Retail, (ii) Corporate Clients, (iii) Human Capital, (iv) Management Information System (MIS), (v) Investment, (vi) Business Monitoring and (vii) ESG. The Steering Groups have no rules of their own, their composition and rules of procedure being decided on a case-by-case basis by the members of the Executive Board of Directors.

Biographies

Chief Executive Officer (“CEO”)

Mark Bourke joined novobanco as Chief Financial Officer- CFO in March 2019 and in August 2022 was appointed as the Chief Executive Officer - CEO of novobanco.

Mr. Bourke is a Financial Services specialist professional with a vast career in the most important companies in the field. He got his Diploma in Accounting from Dublin City University after finishing his bachelor’s degree in Engineer Electronics from University College Dublin.

Mr. Bourke began his career at PricewaterhouseCoopers (PwC) in 1989 and is a former partner in international tax services with PwC US in California. After that in the year 2000, Mr. Bourke joined IFG Group as a Finance Director and was promoted Group Chief Executive Officer in 2006. Before joining novobanco, Mr. Bourke was the Chief Financial Officer of Allied Irish Banks (“AIB”) and member of AIB’s Leadership Team, from 2014 to 2019. He is a member of Chartered Accountants Ireland and the Irish Taxation Institute. Mr. Bourke won the Irish Times CFO of the Year Award 2018.

Chief Financial Officer (“CFO”)

Benjamin Dickgiesser joined novobanco's Executive Board of Directors in February 2023 as the Chief Financial Officer (CFO).

Prior to his role at novobanco EBD, Mr. Dickgiesser served as the Managing Director for Hudson Advisors Portugal LDA, where he provided support for underwriting and management of Lone Star Fund's investments in European financial institutions.

Mr. Dickgiesser was also a member of novobanco's GSB.

With extensive experience and knowledge gained over the past five years in the Portuguese market and banking system, Mr. Dickgiesser possesses a profound understanding of novobanco's operations, strategic direction, and deep knowledge of capital markets.

He holds a Master's degree (MSc) from University College London and has more than 15 years of experience in financial markets. Mr. Dickgiesser has worked in the Financial Institutions Group of Citigroup's Investment Banking Division in London and has held positions at Lone Star Europe Acquisitions LLP. Additionally, he served as a Member of the Supervisory Board of IKB Deutsche Industriebank AG in Germany.

Chief Commercial Officer Corporate (“CCOC”)

Luis Ribeiro is graduated in Economics by Universidade de Évora, attending the Advanced Management Program for Executives of Universidade Católica as well as the Advanced Executive Program of Nova SBE.

Mr. Ribeiro is a member of novobanco board of directors since September 2018, and also member of the board of directors of novobanco dos Açores, of Unicre - Instituição Financeira de Crédito S.A and of SIBS Forward Payment Solutions, S.A..

Mr. Ribeiro has more than twenty-five years of commercial banking experience, and throughout this period he performed a vast number of management roles, including being responsible for the coordination the southern corporates segment and previously for the retail segment.

Chief Commercial Officer Retail (“CCOR”)

FALTA TEXTO

Chief Legal Compliance & Sustainability Officer (“CLCSO”)

Luísa Soares da Silva has a degree in Law from Universidade Católica Portuguesa, Lisbon. Mrs. Soares da Silva has additional training in European law, finance and capital markets, as well as the Advanced Executive Program of Nova SBE and Strategic Management in Banking programme of Insead.

Mrs. Soares da Silva joined novobanco in April 2017 as an executive member of the Board of Directors. Before joining novobanco, Mrs. Soares da Silva practiced law, especially in the areas of financial, banking, insurance, capital markets and corporate activities at Morais Leitão, Galvão Teles, Soares da Silva & Associados (MLGTS), being a Partner since 2001. Since early in her career, Mrs. Soares da Silva has permanently advised banking and insurance institutions. Throughout her career, Mrs. Soares da Silva has received several recognitions, including Leading Lawyer in Capital Markets IFLR and Mergers and Acquisitions IFLR in 2016.

Chief Risk Officer (“CRO”)

Carlos Brandão is graduated in Economics, has a Master on Commercial and Marketing Management and an Advanced Management Program.

Mr. Brandão joined novobanco as Coordinating Director of Risk Department in July 2017, and in August 2022 he was appointed as an executive member of the Board of Directors.

Mr. Brandão has more than 20 years of experience, managing large and high-performing risk teams across important players of the banking sector. Mr. Brandão was Risk Director on Banco Santander Totta e Barclays Bank, renowned institutions in the Spanish and English markets.

in 2008, Mr. Brandão joined to Barclays Bank in Portugal as first as Chief Risk Officer and in 2016 was appointed to be CEO and Country Manager, being responsible for Risk, Retail and Internal Control areas.

Chief Credit Officer (“CCO”)

Rui Fontes has an Economics degree by Faculdade Economia da Universidade do Porto (FEP).

Mr. Fontes is an executive member of novobanco Board of Directors April 2017, acting as responsible for Risk and Internal Control Areas and in October 2017, he was appointed as Chief Risk Officer. In August 2022 Mr. Fontes was appointed as Chief Credit Officer.

Mr. Fontes joined the banking sector in 1994, having assumed several job positions first in the commercial area and after in the credit risk area. In 2000, he joined the Global Risk Department and in 2012 assumed the responsibility for the coordination of this Department, which he maintained during the transition to novobanco and until his appointment as board member.

Scope

Responsible for issuing an opinion on, approving, under the powers delegated by the Executive Board of Directors, and monitoring novobanco Group’s policies and risk levels. In this context, the Risk Committee is responsible for monitoring the evolution of GNB’s integrated risk profile, and for analysing and proposing methodologies, policies, procedures and instruments to deal with all types of risk, namely credit, market, liquidity and operational.

Responsible for deciding the main credit operations in which the novobanco Group participates, in line with the risk policies defined for novobanco Group.

Responsible for the definition of the balance sheet management policies (capital, pricing, and interest rate, liquidity and foreign exchange risk) and for monitoring their impact at novobanco Group level. The CALCO also monitors early warning indicators with regard to the Recovery Plan and Liquidity, proposing mitigation measures, and if necessary, triggering the recovery plan and/or the liquidity contingency plan.

The Committee monitors all issues related to novobanco Group’s Internal Control System, without prejudice to the responsibilities attributed in this regard to the Executive Board of Directors and other Committees in place at novobanco Group, namely the Risk Committee, the Operational Risk Subcommittee and the Compliance and Product Committee.

Responsible for approving, from a compliance standpoint, products and services to be developed and/or distributed by the bank, issuing an opinion on all of them within the scope of the products’ sign-off process in force, as well as monitor the issues related to control implementation, without prejudice of competences of other governing bodies and GSB Committees.

Responsible for defining and driving digital transformation at novobanco.

Responsible for approving the execution of expenses, within the limits of the powers conferred upon it. Its objectives include the definition of an annual expenditure plan and the revision of the acquisition’s strategy.

Responsible for defining the amount of impairment to be allocated to each client, when novobanco has an exposure above €100 million to that client or group of clients.

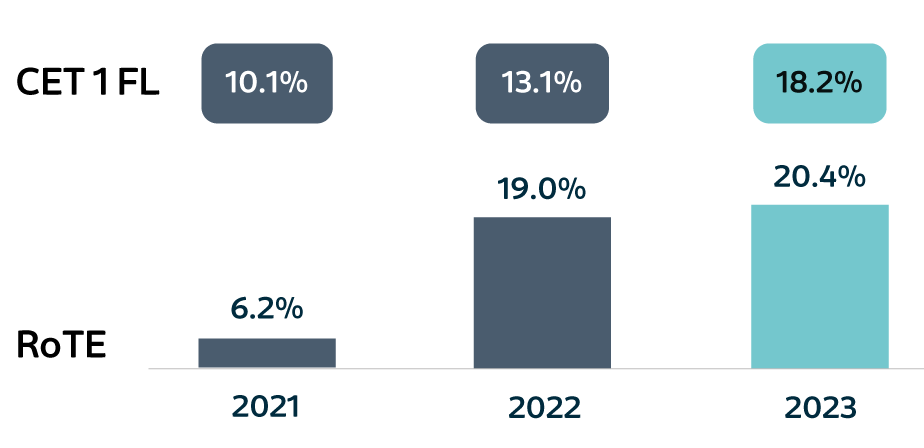

Our Results

| 2023 Guidance | 2023 Achievements | ||

|---|---|---|---|

| Net Interest Margin | > 2.5 % | 2.7 % | ✓ |

| Cost to Income | ~ 35 % | 33 % | ✓ |

| Cost of Risk | ~ 50 bps | 48 bps | ✓ |

| NPL Ratio | < 4.5 % | 4.4 % (w/84%coverage) | ✓ |

| Profit Before Tax | > €700 mn | € 754 mn | ✓ |

| Capital Generation | > 400 bps | + 500 bps (CET1: 18.2€) | ✓ |

| Rating actions | MOODY'S (DECEMBER 2023) | FITCH (FEBRUARY 2024) |

|---|---|---|

BA1 (Positive Outlook) Senior Unsecured Debt +7 notches in 2 years | BBB- (Stable Outlook) Senior Debt Investment Grade |